Homeowners Insurance in and around Liberty

If walls could talk, Liberty, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance doesn't just protect your house. It protects both your home and your valuable possessions. In the event of a tornado or falling trees, you could have damage to the items in your home in addition to damage to the structure itself. Without insurance to cover your possessions, you may struggle to replace all of the things you lost. Some of your possessions can be replaced if they are lost or damaged outside of your home, like if your car is stolen with your computer inside it or your bicycle is stolen from work.

If walls could talk, Liberty, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Agent Cyndi Davidson, At Your Service

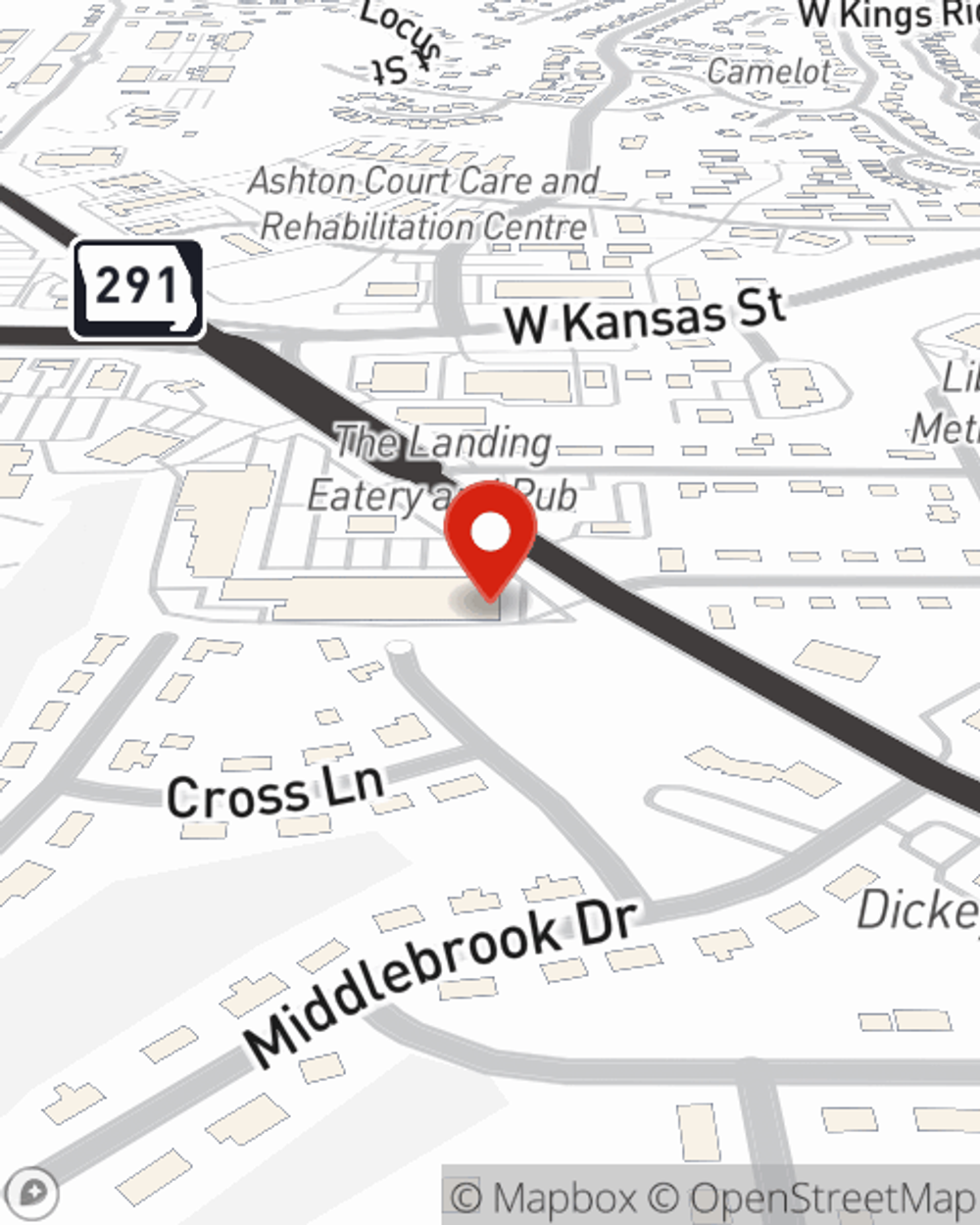

Great coverage like this is why Liberty homeowners choose State Farm insurance. State Farm Agent Cyndi Davidson can offer coverage options for the level of coverage you have in mind. If troubles like sewer backups, service line repair or wind and hail damage find you, Agent Cyndi Davidson can be there to help you file your claim.

Call or email State Farm Agent Cyndi Davidson today to find out how an industry leader in homeowners insurance can help protect your house here in Liberty, MO.

Have More Questions About Homeowners Insurance?

Call Cyndi at (816) 781-5991 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Help conquer home humidity problems with these tips

Help conquer home humidity problems with these tips

High home humidity is not only uncomfortable, it can also threaten your home’s structure and surfaces. Help clear the air with tips on how to reduce indoor humidity.

Cyndi Davidson

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Help conquer home humidity problems with these tips

Help conquer home humidity problems with these tips

High home humidity is not only uncomfortable, it can also threaten your home’s structure and surfaces. Help clear the air with tips on how to reduce indoor humidity.